Generational Relationships

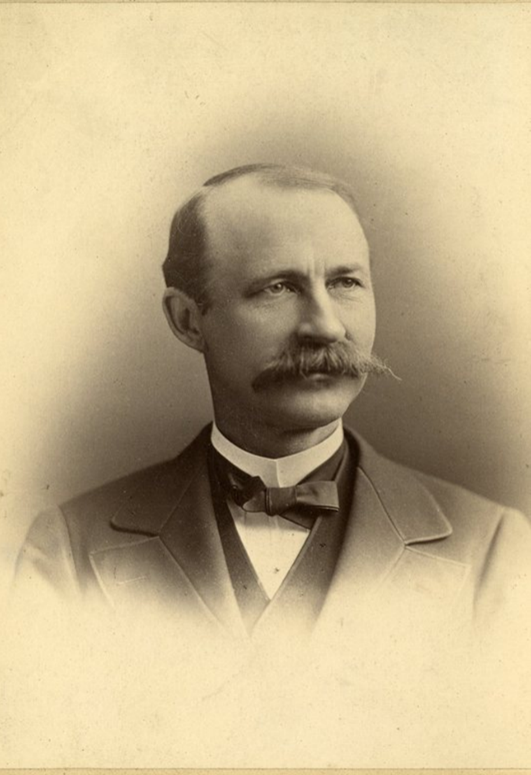

Did you know the first President of the National Dental Association was a Maine Private Practice owner?

Dr. Thomas Fillebrown opened his practice in 1869. He was a second-generation dentist and he carried forward a legacy which continues to the modern day. Over 150 years after Thomas established his dental clinic, Royer Advisors and Accountants helped his direct descendant (Dr. Jacob Fillebrown) purchase a legacy Private Practice in Scarborough, ME. The Fillebrown family’s impact on Maine Dentistry is measured in centuries, not years.

Dr. Thomas Fillebrown

Maine has a rich history of private practice dentistry.

Private Practice Dentistry is a choice.

Purchasing a legacy dental practice is an investment in generational relationships built on trust and quality care. It is not a decision to be taken lightly, and it requires a comprehensive and integrated plan that considers all aspects of the investment.

Royer Advisors are experts in navigating successful private practice transitions. If you are considering a practice acquisition, give us a call. It will be the last time you find yourself uncertain about what comes next.

Whether you are beginning your search for the perfect office or issuing a letter of intent, Royer will help you integrate and implement a comprehensive tax and finance strategy to ensure purposeful results for your practice, family and future.

• Buyer Representation Services

Royer has developed a “Buyer Organizer” that helps us isolate all of the key aspects of an existing practice in an easily digestible format. From understanding discretionary owner benefits, to modeling potential financing scenarios, Royer should be your first call when considering a practice acquisition.

• 360* Practice Financial Analysis

Royer understands that running a dental business requires more than clinical excellence. Our advisors can help you analyze all aspects of your practice to achieve purposeful financial results.

• Finance Strategy

Royer Advisors understand that your tax and finance strategies must align. Our advisors truly understand the finance and lending needs of private practice business. We help our clients work better with their banks and lenders. Not getting what you need from your current bank? We can help with that too.

• Loan and finance structuring and support

Not all banks understand private practice business lending. If you are not working with a healthcare lender, you are overpaying for your loan. The Royer team works with many bank partners that specialize in practice lending. Our advisors will ensure you are getting the most out of your banking relationship.

• Integrated Tax Strategies

It is often difficult to separate the business from the individual when discussing private practice dentistry. Many of our clients also own commercial real estate and even other (non-dental) businesses. Our team will ensure your tax plan is designed specifically to maximize your individual situation.

• Real Estate Services

Many of our dental clients own commercial real estate. Our team understands how to integrate your real estate into your tax planning and how to maximize the potential tax benefits of your real estate property.

• New Entity Formation

Royer works with attorneys that understand private practice business. The tax code changes constantly. Our team can help you ensure you are maximizing your tax strategy when considering an acquisition or expansion that requires the formation of a new business entity.

• Practice Bookkeeping

The Royer team works with dozens of private practice dental offices in Maine. We offer various levels of bookkeeping services. Some of our dental clients completely outsource their bookkeeping to Royer. Whatever your specific need, we will work with your team to decide what works best for you.

• CPA & Tax Services

Royer is the premier private practice accounting and advisory firm in Maine. We work with non-dental businesses, but we do not accept stand-alone personal tax clients. Our team works exclusively with business owners and their families. We tailor our accounting and tax services proposals to your specific need and integrate your personal and professional financial goals into a comprehensive tax strategy that serves the needs of your family and your business.